tax

Tax Calculation In VTiger

November 30, 2016

Article

When a firm is carrying out its business operations in a country, it is the legal obligation of a company to pay the taxes according to that country’s constitution and law. There are several direct and indirect stakeholders that are affected by the operation of a company. List of direct stakeholders consists of customers, suppliers, distributors etc. And the list of indirect stakeholders comprises of the environment, general public, government etc. The government is an indirect stakeholder but is affected by the business firms and in return of facilities provided by the government companies have to pay something in financial terms to the government and that is where the concept of taxations comes. Using tax collected from firms and individuals government fund program for a better lifestyle of their citizens. “I like to pay taxes. With them, I buy civilization.”

Abate The Tax & Charge Associated Setbacks Around The Globe With VTiger

May 8, 2016

Article

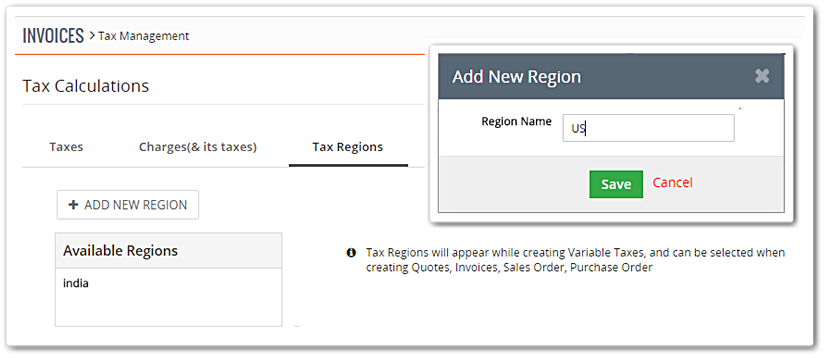

A business of any rank needs to deal with tax, a fee charged (levied) by a government on a product, income, or activity. That fee is to be calculated, charged, and received from customers. It is a complex task that requires time and resources of a company. The calculations cannot be completely avoided of course, but the system can be handled quite professionally with Vtiger 7’s Tax Management System. With this hallmark, you can cope with local and international tax rates and problems pretty efficiently. Note! Tax Management System is available in only in Sales Professional Edition and Ultimate Edition. Tax Calculation All of the complicated computations regarding tax can be systemized in Vtiger 7. When the calculations are configured, those will be accessible to utilize in Quotes, Sales, Orders, Invoices, and Purchase Orders. Taxes defined in Tax Calculations are global, and not limited to products. Here is how you can set up taxes in Vtiger 7: Click on